Money doesn’t always equal mindless spending. In fact, the wealthy often pass on purchases that most people make without a second thought. While it might seem odd that someone with millions in the bank skips over small, everyday buys, there’s a method to their money habits.

Rich people think about time, energy, and opportunity cost more than the price tag alone. That mindset changes the way they see shopping carts, receipts, and routines.

Skipping Daily Coffee Runs

It’s not that rich people hate coffee—they just think differently about it. Buying a $7 latte every morning feels inefficient when convenience and consistency can come from brewing it at home or having a private barista on staff. They view repeated micro-purchases as wasted decisions that drain focus. Instead of standing in line at a café, they prefer systems that cut out friction. The goal is to streamline habits, not splurge on small, everyday rituals.

Saying No to Fast Fashion

Wealthy shoppers often skip cheap clothing because they value longevity and quality. Fast fashion might be trendy, but it loses shape, fades, and feels disposable after a few washes. Investing in custom pieces, timeless cuts, or designer staples saves them from constant replacement. They’d rather buy once and wear for years than refill their closet every season. To them, cheap clothes carry a hidden cost: time wasted shopping again and again.

Avoiding Overly Packaged Groceries

Buying pre-cut fruit, single-serve snacks, or overpackaged items may seem convenient, but the rich often pass. They prefer bulk, fresh, or specialty goods that align with quality, health, and environmental concerns. Many wealthy households even outsource meal prep or employ chefs, skipping grocery aisles altogether. Overpaying for something with more plastic than product doesn’t fit their efficiency mindset. In their world, convenience looks different—it’s curated, not prepackaged.

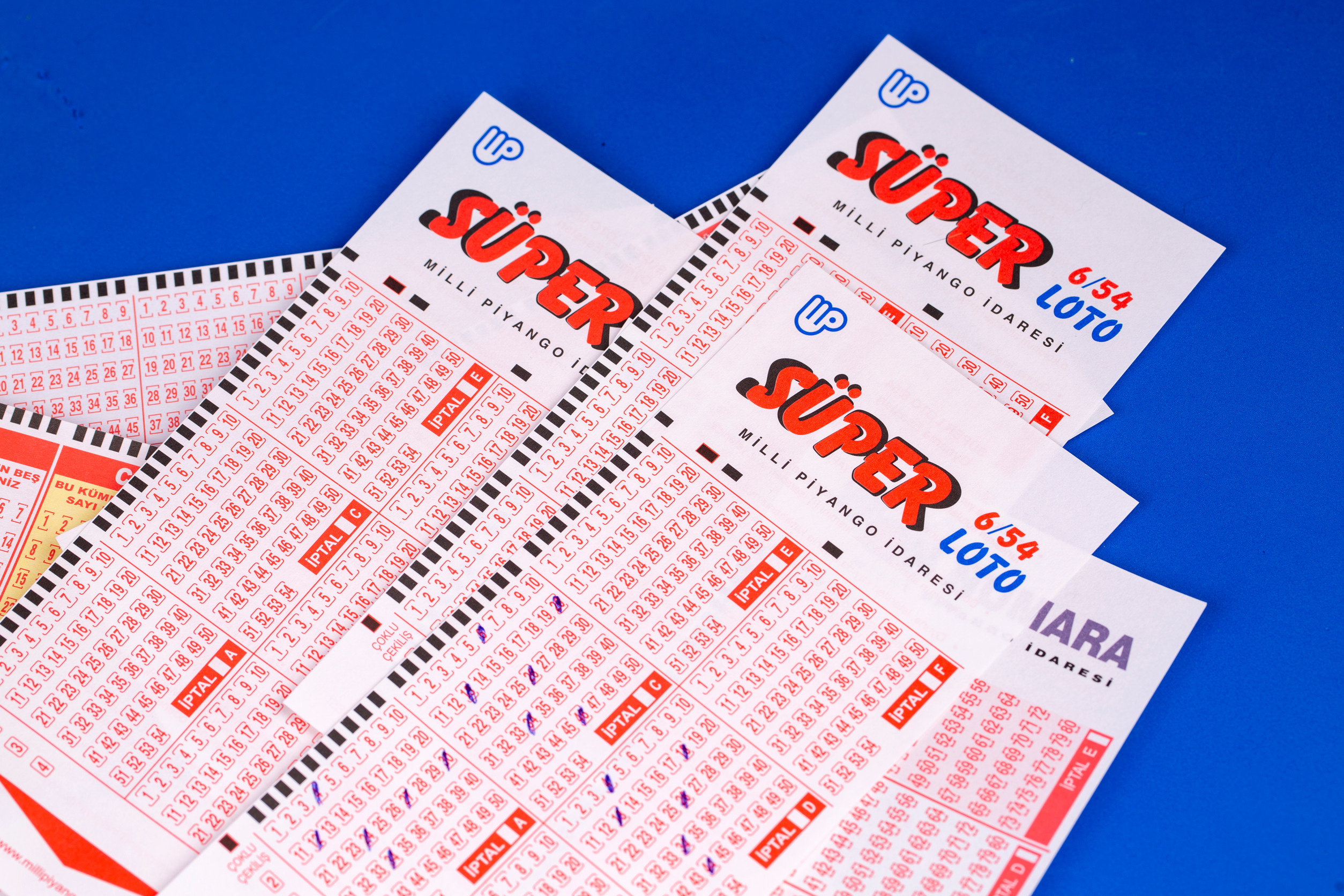

Steering Clear of Lottery Tickets

The wealthy understand odds, and lottery tickets scream bad math. Spending small amounts on a dream of winning big doesn’t match their wealth-building philosophy. They’d rather put money into investments with predictable returns, even if the payoff takes time. A scratch-off feels like burning cash on pure chance. For them, wealth is about strategy, not luck.

Refusing Extended Warranties

Extended warranties look like protection, but the rich often see them as unnecessary add-ons. They can afford repairs or replacements without stressing over coverage. More importantly, they know warranties are designed to make companies profit, not customers. Instead of paying for peace of mind, they rely on smart buying decisions and trusted products. Skipping warranties keeps transactions lean and efficient.

Passing on Discount Shopping Sprees

Sales and discounts trigger excitement for many, but the wealthy usually aren’t swayed. They buy with intention, not impulse, so markdowns rarely matter. Shopping bags full of “deals” often mean wasted money on things never used. Rich people focus on value, not the thrill of getting more for less. To them, time spent chasing bargains isn’t worth the clutter it brings home.

Ignoring Name-Brand Essentials

Toilet paper, paper towels, and cleaning supplies aren’t areas where rich people care about logos. They know generic versions often match quality at a fraction of the cost. Spending extra for a brand name doesn’t make daily necessities perform better. They’d rather save mental energy for decisions that actually matter. Prioritizing impact over image keeps their focus sharp.

Avoiding Trendy Tech Gadgets

Rich people don’t rush to buy every new gadget just because it’s trending. They often wait until technology proves useful, reliable, and integrated into their lifestyle. Chasing the latest release feels like unnecessary clutter. Instead, they buy tools that genuinely enhance productivity or enjoyment. Their approach: tech should work for them, not the other way around.

Passing on Subscription Overload

Streaming services, apps, and monthly boxes can pile up quickly. The wealthy often keep subscriptions lean, focusing on what they actually use. Too many micro-payments add mental clutter and reduce efficiency. Rather than juggling ten different services, they prefer a few premium ones that deliver real value. Simplifying commitments keeps their finances and minds clear.

Skipping DIY Fixes

While many people tackle home repairs or chores themselves, the rich usually skip DIY projects. They see time as more valuable than money, so hiring professionals makes more sense. Doing it themselves isn’t about saving cash—it’s about spending hours better elsewhere. Outsourcing ensures high-quality results without the stress or risk of mistakes. Efficiency, not frugality, drives this choice.

Avoiding Everyday Impulse Buys

Rich people rarely toss last-minute items into carts at checkout. Impulse spending feels careless and misaligned with their intentional approach to money. Instead, they stick to lists, plans, or assistants who shop for them. The thrill of small, random purchases doesn’t appeal when clarity and control are the priority. Every purchase serves a purpose, not a passing urge.

Skipping Low-Value Insurance

Insurance for phones, appliances, or travel extras often gets a pass from the wealthy. They know premiums outweigh the actual risk. With financial safety nets already in place, minor losses don’t threaten stability. For them, insurance makes sense only for major, life-altering events. Everything else is a hassle that doesn’t add real value.

Rethinking Everyday Spending

Wealth doesn’t mean buying without thinking—it means buying with precision. Rich people avoid certain everyday purchases not because they’re cheap, but because they understand the true cost of time, energy, and focus. Their choices highlight a mindset where efficiency outweighs convenience, and value beats volume. Next time you consider a small, routine buy, think about whether it serves you—or just fills space.

What are your thoughts? Drop a comment and share which everyday purchases you’d skip if money weren’t the issue.

You May Also Like…

- What Happens When Rich Donors Control Local School Funding

- 9 Everyday Items That Cost Poorer Families More Than the Wealthy

- Why Are So Many Middle-Class Families Paying More in Bank Fees Than the Wealthy

- Why Do Rich Neighborhoods Often Get Faster Emergency Services

- 10 Sign-Posts That Tell You When You’re Falling Toward Impulse Spending