Probate is already a slow, sometimes frustrating process, but there’s one small, everyday bill that can bring it all to a screeching halt. It’s not the mortgage or the taxes—it’s a simple utility bill that most people don’t think twice about. This forgotten detail can freeze accounts, hold up asset transfers, and even spark disputes among heirs.

Families expecting a quick resolution could find themselves tangled in legal knots over something worth less than a dinner out. Understanding why this happens—and how to prevent it—is key to avoiding probate gridlock.

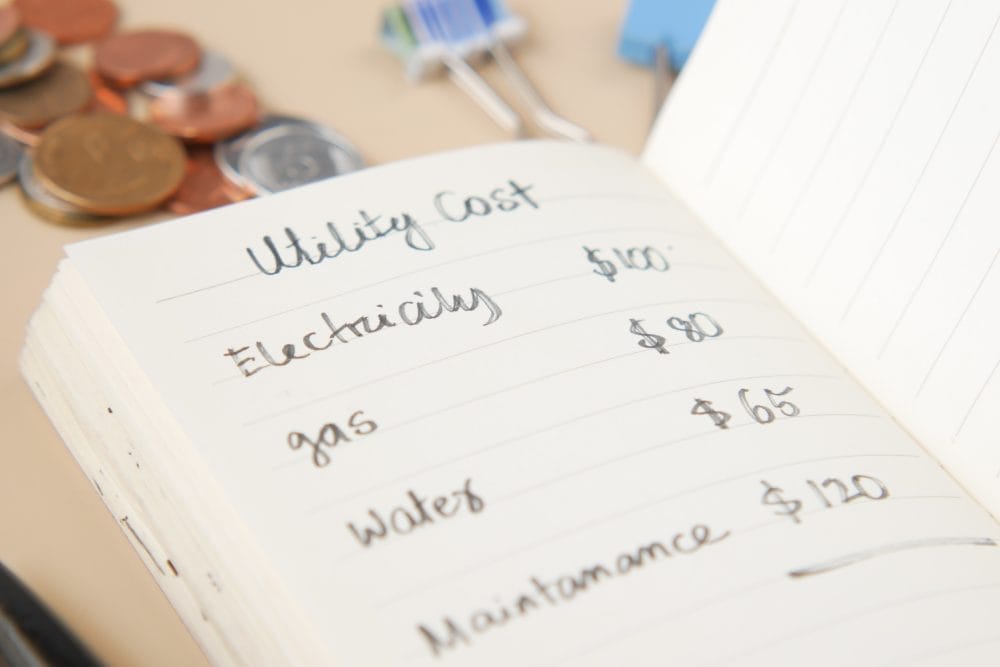

Why a Utility Bill Holds So Much Power

A utility bill might seem minor, but it can have an outsized impact during probate. When the deceased’s name is on the account, companies often require legal proof before allowing changes or cancellations. That means no one can switch it to a different name or close it until probate authority is granted. If that bill is tied to essential services—like electricity for a property being sold—the case can stall until it’s resolved. This isn’t about the amount owed; it’s about the legal control over the account.

The Legal Domino Effect of an Unpaid Bill

An unpaid utility bill can start a chain reaction in probate proceedings. If the property can’t maintain utilities, inspections, appraisals, or sales could be delayed. This, in turn, pushes back deadlines for other legal steps, frustrating beneficiaries and attorneys alike. Creditors may even file claims against the estate for small amounts, forcing the court to address them before moving forward. A single overlooked $60 bill can, in extreme cases, delay a six-figure property sale.

How Utility Companies Handle Deceased Accounts

Utility companies follow strict protocols when a customer dies. Most will freeze accounts until the estate’s executor or administrator provides court-issued letters of authority. Without those, they can’t legally release information or process changes, even if relatives offer to pay the balance. This process is meant to prevent fraud, but it can unintentionally paralyze estate administration. The result is an uncomfortable waiting game where legal paperwork must catch up before practical issues can be solved.

The Probate Court’s Perspective

From the court’s point of view, every creditor—no matter how small—must be treated equally. A utility company is just another creditor, with the same rights as a bank or mortgage lender. If a utility files a claim, the court cannot close the estate until it’s settled. That’s why something as basic as a water or power bill can hold equal weight to much larger debts in probate timelines. The law doesn’t measure importance by dollar amount, but by proper closure of all obligations.

Property Sale Roadblocks

When an estate includes real estate, utilities become more than just monthly expenses—they’re part of the sale process. Realtors often need active electricity, water, or gas for showings and inspections. If a utility account can’t be transferred or turned back on because of probate restrictions, a sale can stall for weeks or months. This delay can cause buyers to back out, forcing the estate to start negotiations all over again. The longer the property sits, the more it costs the estate in taxes, insurance, and upkeep.

How Executors Can Prevent the Problem

Executors who act quickly can prevent a utility bill from holding probate hostage. As soon as death is confirmed, they should notify utility companies and request temporary account changes when possible. Some companies have “executor accounts” that keep services active without violating legal protocols. This approach keeps properties market-ready while the legal paperwork moves forward. Taking these steps early reduces the risk of last-minute surprises that can derail timelines.

When Beneficiaries Disagree on Payment

Sometimes the real delay isn’t the utility company—it’s the heirs. Beneficiaries may argue over who should pay ongoing bills before the estate’s assets are distributed. These disputes can become emotional, especially if family members live in or use the property during probate. The longer they argue, the longer the bill goes unpaid, and the closer the estate gets to delays or legal interventions. Clear communication and written agreements can prevent these conflicts from escalating.

The Financial Snowball Effect

An unpaid utility bill can lead to late fees, reconnection charges, and even property damage if services are cut off. For example, without heat in winter, pipes can burst, causing thousands of dollars in repairs that the estate must cover. These extra costs not only shrink the estate’s value but also extend the probate process. What started as a $40 oversight can spiral into a five-figure expense and a lengthy legal headache. Preventing the snowball effect starts with prompt, careful account management.

Real-World Examples of Delays

There are documented probate cases where a small utility bill held up final closure for months. In one case, a property sale couldn’t proceed because water service couldn’t be restored without court approval. In another, heirs fought over responsibility for unpaid electricity bills, dragging the case past its original closing date. These aren’t rare exceptions—they’re common enough that estate attorneys warn clients about them. The lesson is clear: even tiny debts demand immediate attention in probate.

Small Bill, Big Problem

A single unpaid or unresolved utility bill has the power to stall an entire probate case. While the amount might be small, the legal and logistical consequences can be huge. Executors and families who stay ahead of these details can keep the process moving smoothly. Ignoring them can turn a simple estate into a drawn-out, expensive ordeal.

Have you ever seen a small detail cause a big legal delay? Share your thoughts or stories in the comments.

Read More

How “Smart” Thermostats Are Flagging Tenants for Lease Violations

Why Some Landlords Are Now Tracking Water Usage to Spot Lease Violations